The Financial Counselling- Statistics Report provides the statistics required to report to various funding agencies.

Instructions

Step 1. Log into your CRM database (refer to Logging On for further information).

Step 2. Select Reports from the top menu

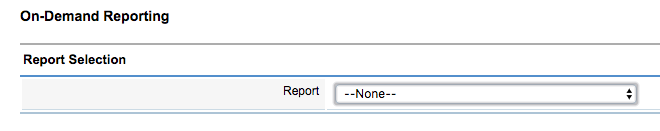

The On-Demand Reporting page is displayed

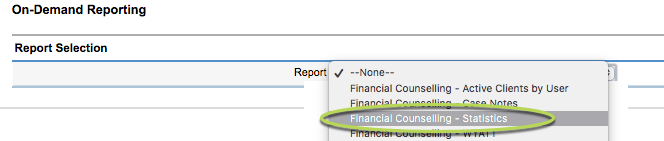

Step 3. Select the Financial Counselling – Statistics Report from the list

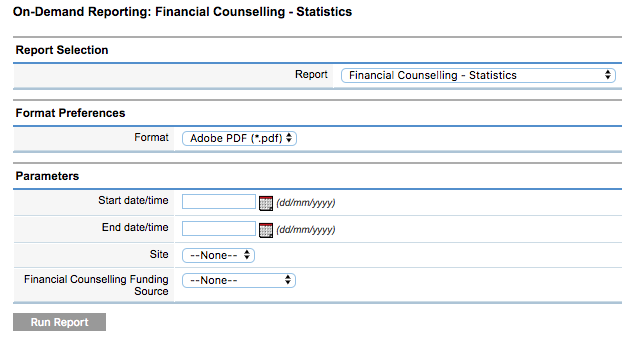

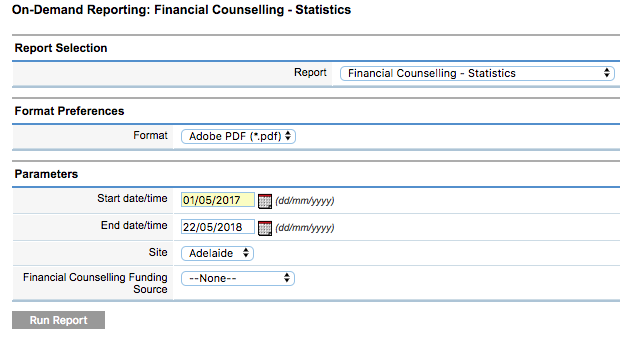

Step 4. The parameters are displayed

Enter the required parameter information

- Select the required start and end dates for the reporting period

- Select the required Site (if required). If not selected, all Sites will be included.

- Select the Financial Counselling Funding Source (if required). If not selected, all Funding Sources will be included.

Step 5. Click Run Report

Once the report has completed processing, click the ‘Click Here to Download’ link

Step 6. The Report will display in your browser, or open with your PDF viewer, depending on your computer’s settings.

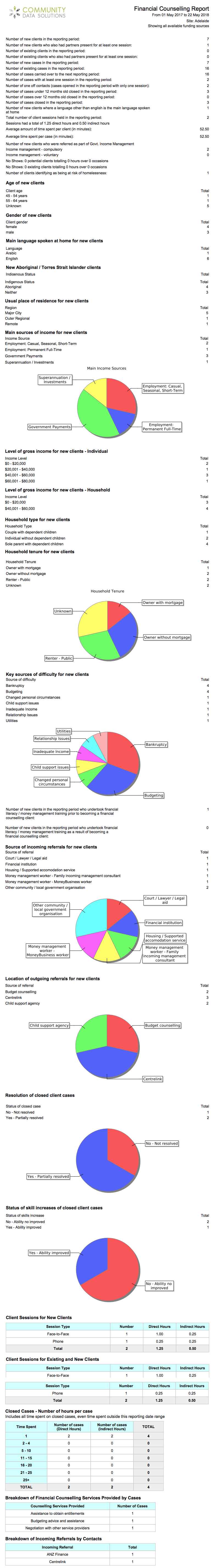

The Financial Counselling – Statistics report is displayed.

The Report lists the following information:

- Summary of clients and cases in the reporting period

- Demographics of new clients

- Key Sources of difficulty for new clients

- Sources of incoming referrals for new clients

- Location of outgoing referrals for new clients

- Resolution of closed client cases

- Status of skill increased of closed client cases

- Client sessions summary

- For new clients

- For existing and new clients

- Closed cases – hours per case

- Services provided per case

- Incoming referrals by contacts

- Postcode of new clients

Number of new clients in the reporting period – Number of clients who had a Financial Counselling case opened in the reporting period for the first time in their history. If a client had a different case opened prior to the reporting period, they will not be counted here.

Number of existing clients in the reporting period – Number of clients who had a Financial Counselling case opened in the reporting period, but have had a different case opened prior to the reporting period. The number of existing clients and the number of new clients should total the number of new cases in the reporting period. Clients must adhere to the following to be counted

- Client must be unique

- Client must have more than 1 case

- One case with a service date before the reporting period

- Second case that has both service date and date closed values are in the reporting period

Number of existing cases in the reporting period – Number of cases that were open on the start date of the reporting period. These cases were opened prior to the start date and were either closed during the reporting period or remain open at the end of the reporting period. Existing cases must adhere to the following rules in order to be counted

- Case must be unique

- Service Date must be earlier than the service date value in the Case

- Either Case is “Closed” AND Exit Date is within the reporting period OR the Case remains open at the time of report generation

Difference between count of Existing Clients and Existing Cases

- Existing cases only care about services that were closed in the reporting period(cases must have been created before that reporting period in order to be counted).

- Existing cases do not have to have a unique client.

- Existing clients have to have more than 1 case, and the first case must be created before the reporting period began.

- Existing clients can only be counted once in a reporting period.

- Existing clients must have cases that are both started and ended in the reporting period.

- Because of the differences between how existing cases and existing clients are calculated, it’s quite possible that some of the existing cases are connected to clients that didn’t fit the criteria for inclusion as an existing client.

Number of cases carried over to the next reporting period – Number of cases with a service date before the end of the period and still open at the end of the period

Number of cases with at least one session – Number of cases which had one or more sessions during the period.

Intuitively, the number of Cases recording a session in the reporting period should equate to the number of existing Cases and the number of new Cases in the reporting period. However:

- Existing/new Cases may not record a session in the reporting period

- Cases closed after the reporting period may not be recognised as existing Cases, but may have recorded a session in the reporting period.

No Shows – No shows indicate the number of sessions where the “No Shows” checkbox was checked in a session

Main sources of income, Level of gross income (individual + household), Household type, Household tenure, Key sources of financial difficulty, Source of incoming referral – These reports only include the *first* case for the new client as each client may have multiple cases.

Non-casework Clients – Please note, “Non-casework Clients” are for telephone counselling services and may not be relevant for your service. This is relevant for question 1.2 and all of Part 6 of the report.

Further Information

For further information, refer to the following articles: