Prices for NDIS funded support items are provided by the NDIA and are GST exclusive. By default, all support items in your NDIS module are set as GST exclusive and marked as such on the created invoices.

You may have Fee For Service support items that you wish to charge at a GST exclusive rate.

Instructions

To invoice a support item with GST included, you need to update a support item and configure the claim.

Update Support Item

All support item prices are recorded at the GST inclusive price.

As most items are GST free, there is no GST added.

To charge GST on an item you must add the GST component to the recorded price.

Step 1. Log into your CRM database (refer to Logging On for further information).

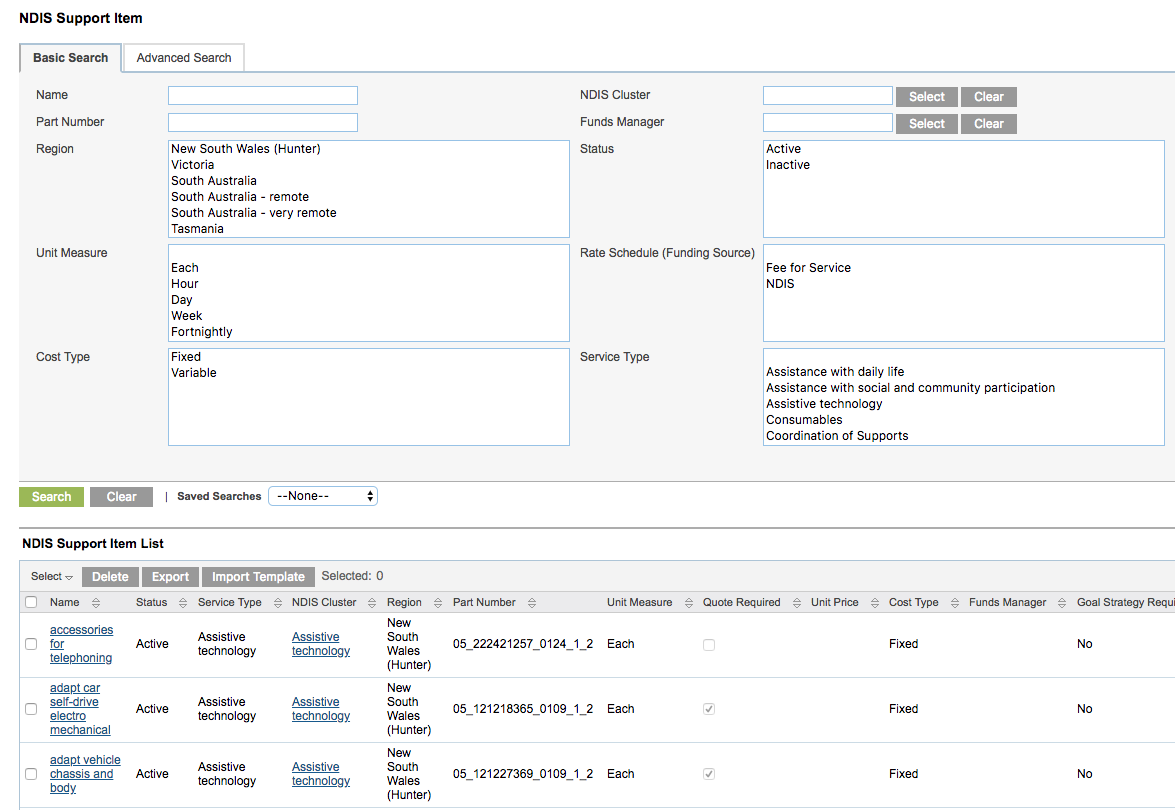

Step 2. Select the Support Item from the Top menu

All currently configured Support Items are listed.

Tip - If not all records are returned, click the Clear button to remove any search filters.

Step 3. Search for the existing support item, or create a new support item.

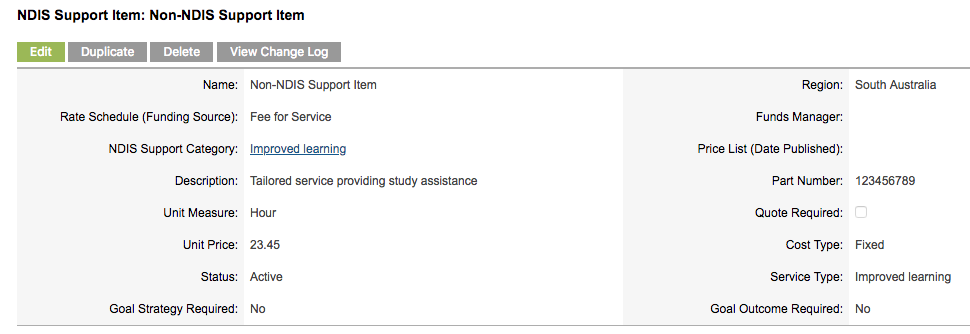

Step 4. Select the required support item

The item details page is displayed

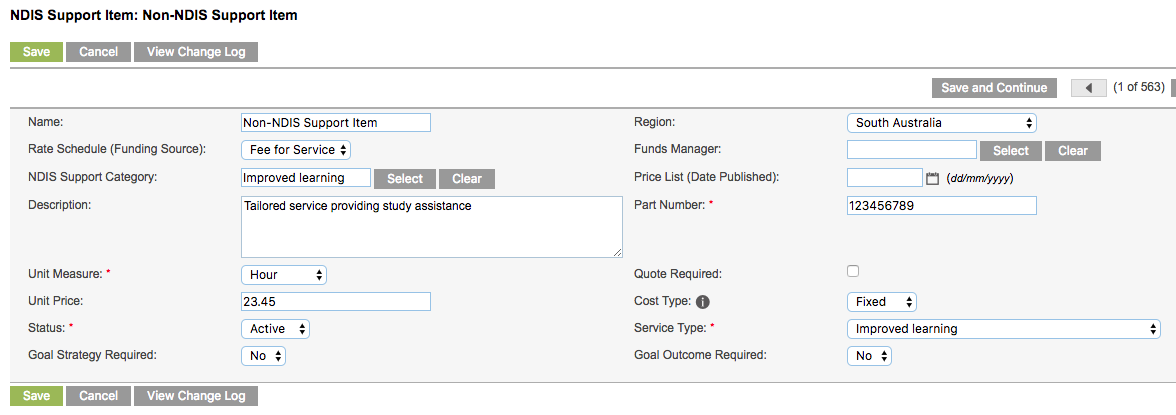

Step 5. Click Edit to enable editing of the item

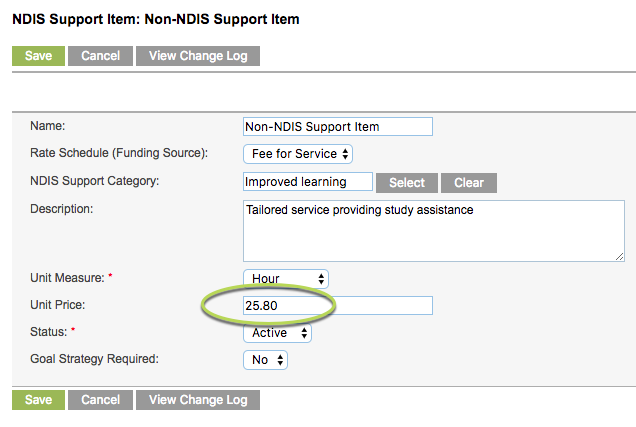

Step 6. Calculate the GST inclusive rate of the item and update the unit price

Step 7. Click Save

The Support Item unit price is updated

Configure Claim

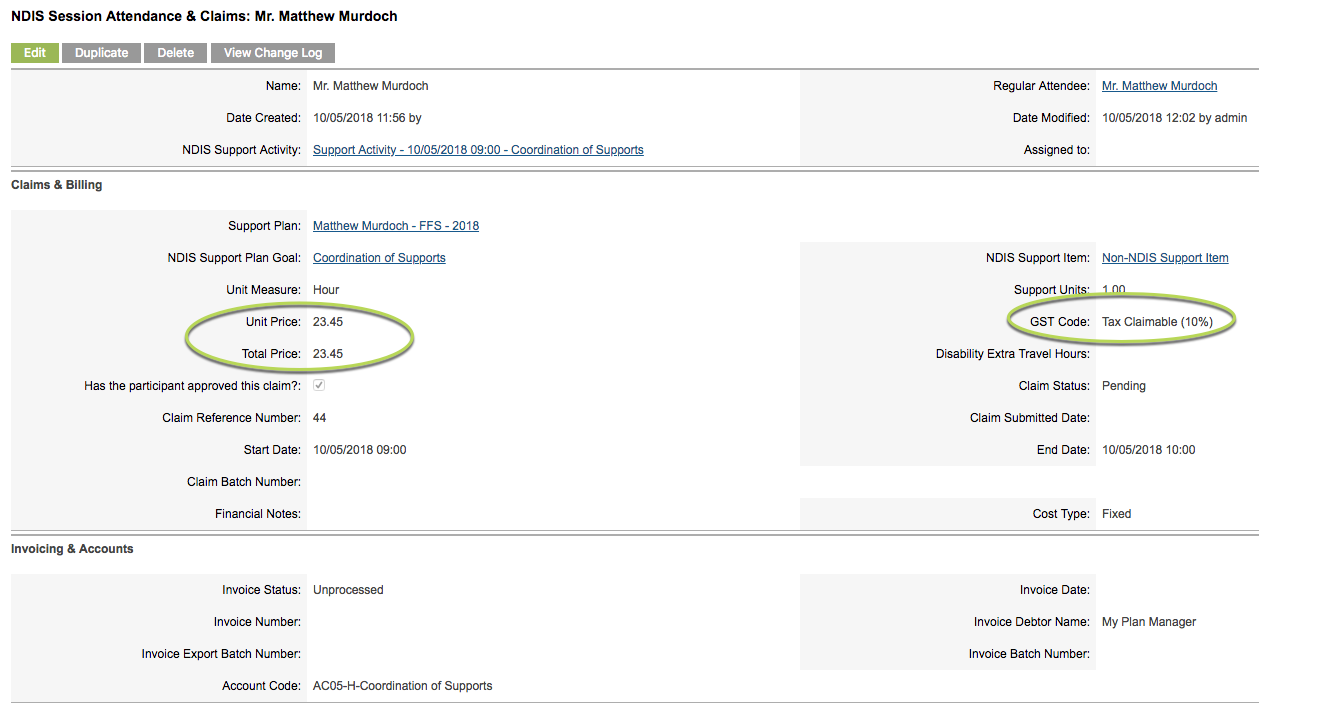

To flag the item as including a GST component, you must set the GST code on the claim to Tax claimable.

Step 1. Once an activity has been delivered, set the activity record as delivered and complete the claim details as required.

Refer to the following articles for further information if required:

Step 2. On the claim screen, click on the GST Code drop-down list

Step 3. Select Tax Claimable (10%)

Step 4. Click Save

The claim is saved with the GST charged price and Code.

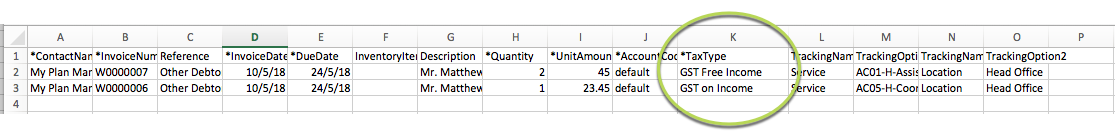

When an invoice file is created for your accounting system, the item will be flagged as GST in Income.

Further information

For further information, refer to the following articles:

- NDIS

- Generate Invoices

- Generate Invoice – Errors

- Create Delivered Support Activity

- Record Session Attendance

- NDIS Provider Toolkit